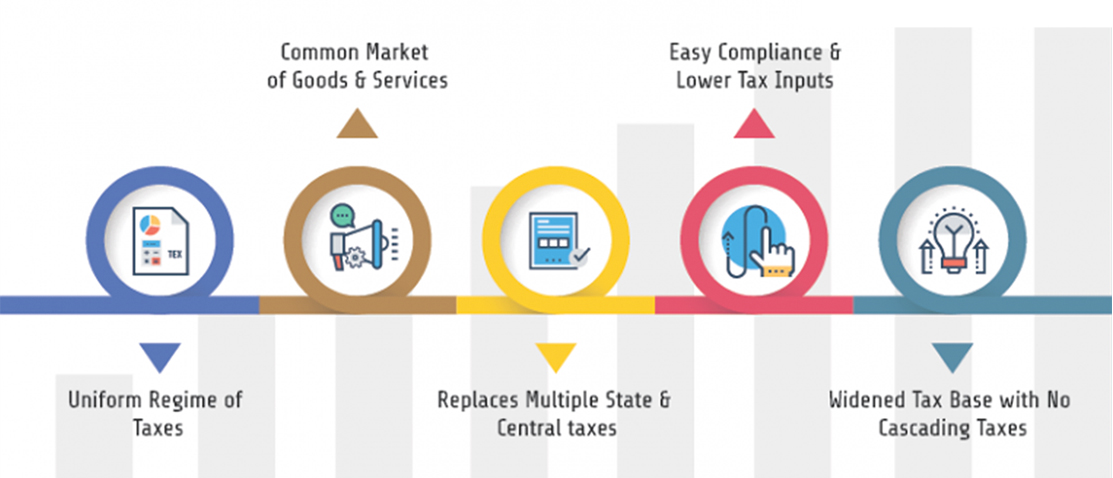

The Goods and Services Tax (GST) is India’s landmark tax reform. A single, comprehensive indirect tax on goods and services throughout India, right from the manufacturer to the consumer, GST has virtually transformed taxation structure in India, rationalising tax collection and simplifying compliance procedures to a great extent. Multiple Central and State levies such as Central VAT, state VAT, service tax, octroi/ entry tax, lottery tax, special additional duty on customs, additional excise duty, countervailing duty, entertainment tax, Central excise duty and purchase tax have now been subsumed into GST levied on the event of ‘supply’ of goods or services. So, businesses now only require a single a GST registration in place of multiple registrations for the above-mentioned wide range of taxes. Though GST is applicable to all products and services, not all businesses require a registration. Businesses with a turnover (supply of goods or services) of more than Rs. 20 lakh (Rs. 10 lakh in North Eastern states) need to mandatorily register for GST. This limit, though, does not apply if the business is involved is selling to other states. It must register for GST regardless of turnover. The Great Solution team comprises highly-experienced professionals to ensure compliance of your business with this revolutionary tax system.

Composition scheme offers reduced tax liabilities to small businesses whose supply turnover is less than Rs. 1.5 crore (Rs 75 lakh in case of North-Eastern states and Himachal Pradesh). These businesses can get rid of tedious GST compliance and pay GST at a fixed, lower rate of turnover. This scheme, however, does not apply to the service industry or to businesses making inter-state sales.

The GST council has decided on a four-tier structure of 5, 12, 18 and 28 per cent. However, Gold is taxed at 3%, and rough diamonds attract a levy of 0.25%.

India has adopted a dual GST model where all supplies will be subject to Central GST and State GST. Intra-state sales will attract Central and State levy, called CGST (Central Goods and Services Tax) and SGST (State Goods and Services Tax). Therefore, the Centre and states will levy GST on all entities. Inter-state sales will attract IGST (Integrated GST), which is a sum total of CGST and SGST.

Head Office

114, 4th Floor, Hari Nagar Ashram

Mathura Road, New Delhi- 110014